It is a general rule of California real estate law that a forged deed is “void,” not merely voidable. Therefore it cannot convey title, even to a good faith purchaser. A good faith purchaser is one who has no knowledge or suspicion of a problem, and pays reasonable value for what they bought. This applies to a buyer at a foreclosure sale. In such a case the buyer, through no fault of their own, ends up with a legal problem and losing money, a good reason to consult an experienced Sacramento real estate attorney. In a recent decision out of Fresno, the buyer at a foreclosure sale not only lost out, but made their situation worse.

I n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

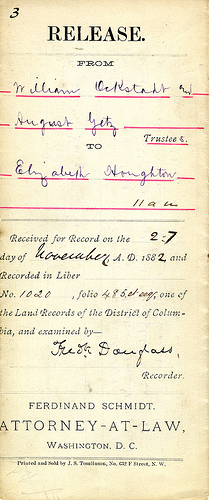

The Baquirans figured out that the second deed of trust was a forgery, and filed suit to quiet title to get the property back. They recorded a notice of action, or Lis Pendens, to provide notice of the suit so that any subsequent buyer of the property is subject to the results of the suit. It turns out that they refinanced in 1997 with broker Williams. Williams got them to sign some documents, which he later revised using whiteout and changing information provided on the document. He brokered some hard money loans, and revised the document so that it appeared to be a deed of trust to one of his hard money lenders. It was this lender who foreclosed.

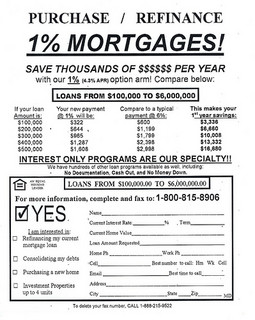

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to  The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale.

The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale. The Mortgage Debt Forgiveness Act requires that the debt was incurred to buy or substantially improve the taxpayer’s principal residence. This includes a refinance loan, to the extent that the principal balance of the old mortgage would have qualified. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately). The amount of debt forgiven must be reported on your tax return. The act first extended such relief for three years, applying to debts discharged in calendar year 2007 through 2009; with the Emergency Economic Stabilization Act of 2008, this tax relief was extended another three years, covering debts discharged through calendar year 2012.

The Mortgage Debt Forgiveness Act requires that the debt was incurred to buy or substantially improve the taxpayer’s principal residence. This includes a refinance loan, to the extent that the principal balance of the old mortgage would have qualified. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately). The amount of debt forgiven must be reported on your tax return. The act first extended such relief for three years, applying to debts discharged in calendar year 2007 through 2009; with the Emergency Economic Stabilization Act of 2008, this tax relief was extended another three years, covering debts discharged through calendar year 2012. The forgiven debt may also be excluded from your income if:

The forgiven debt may also be excluded from your income if: In

In  In

In  In

In  The Association filed a petition, and the court set a hearing date. The judge required homeowners are to be given notice by mail Friday August 13, 2010, and any written opposition from homeowners be filed by the following Tuesday, August 17, only four days later. Usually in legal proceedings, five days are added for mailing. If ,on January 1, I mail to you a motion, it is not deemed received by you until January 5. (Civil Code section 1013) But that was not considered in this case.

The Association filed a petition, and the court set a hearing date. The judge required homeowners are to be given notice by mail Friday August 13, 2010, and any written opposition from homeowners be filed by the following Tuesday, August 17, only four days later. Usually in legal proceedings, five days are added for mailing. If ,on January 1, I mail to you a motion, it is not deemed received by you until January 5. (Civil Code section 1013) But that was not considered in this case.