California Title Insurance policies are, in fact, insurance. The title insurance company offers the property owner insurance that the real estate title is as the insurer represents it to be, subject to some listed exceptions. If the property owner is sued on grounds related to title, the title insurance company is required to defend the owner’s title by defending the lawsuit. It does this through its own attorneys, or by hiring outside counsel to represent the owner in the lawsuit. Anyone involved in a title dispute may want to consult with a Sacramento real estate attorney to determine whether or not they should be defended by their title insurer. It is settled in California that an attorney retained by an insurance company to defend its insured (the owner) under the insurer’s contractual obligation (in the policy) to do so represents, and owes a fiduciary duty to, both the insured and the insurer. Called a tripartite attorney-client privilege, this applies as long as there is no conflict of interest. A recent decision applied the tripartite relationship to the case where the title insurer hired attorneys to prosecute, rather than defend an action -yield a sword rather that a shield.

In Bank of America, N.A. v. Superior Court of Orange County (Pacific City Bank), Cho refinanced her home loan with Bank of America, executing a $608,000 promissory note and related deed of trust. Bank of America obtained title insurance from Fidelity Title Insurance Company, insuring that their loan was in first place. However, five days before the Bank of America deed of trust recorded, and unbeknownst to the bank, Cho also obtained a business line of credit from PCB, secured by business assets PLUS her residence. The PCB Deed of Trust slipped in before Bank of America’s, and B of A’s title company did not catch it. B of A’s loan was in second place. Of course, Cho defaulted on the business loan, and PCB pursued foreclosure. Bank of America tendered a claim to Fidelity under the title insurance policy, and Fidelity hired attorneys who, two days before the trustee sale, filed suit to subrogate B of A to the deed of trust it had paid off, putting B of A’s deed of trust in first place.

In Bank of America, N.A. v. Superior Court of Orange County (Pacific City Bank), Cho refinanced her home loan with Bank of America, executing a $608,000 promissory note and related deed of trust. Bank of America obtained title insurance from Fidelity Title Insurance Company, insuring that their loan was in first place. However, five days before the Bank of America deed of trust recorded, and unbeknownst to the bank, Cho also obtained a business line of credit from PCB, secured by business assets PLUS her residence. The PCB Deed of Trust slipped in before Bank of America’s, and B of A’s title company did not catch it. B of A’s loan was in second place. Of course, Cho defaulted on the business loan, and PCB pursued foreclosure. Bank of America tendered a claim to Fidelity under the title insurance policy, and Fidelity hired attorneys who, two days before the trustee sale, filed suit to subrogate B of A to the deed of trust it had paid off, putting B of A’s deed of trust in first place.

During the lawsuit, PCB sought discovery of communications between Fidelity and the attorney involved in the lawsuit. Bank of America moved to quash the subpoena, claiming attorney -client privilege. PCB made two arguments: 1st, that the attorney client privilege existed only between the attorneys and Fidelity, who had hired them; and 2nd, that Fidelity accepted the tendered claim under a reservation of rights, which created a conflict of interests.

An an

An an  In

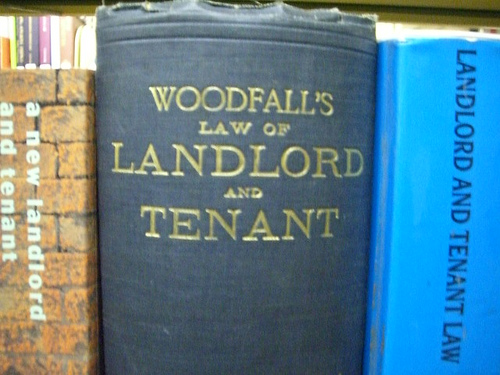

In  The C.A.R. forms used for residential purchase agreements since the October 2002 revision have eliminated the last vestige of “passive” removal of contingencies common in the older forms. The new forms all utilize “active” written removal of contingencies, such that satisfaction of the underlying condition is not enough; there must be a written removal before a contingency is, in fact, removed. If a party does not remove it in writing, it is incumbent on the other to serve a Notice to Perform. Until all contingencies are removed in writing, Sellers always have a right to cancel. Other than the risk of cancellation, there is no penalty to the holder of the contingency if the underlying event occurs but the contingency is not removed in writing. The older C.A.R. Purchase and Sale form copyrighted 1983-1985, is different.

The C.A.R. forms used for residential purchase agreements since the October 2002 revision have eliminated the last vestige of “passive” removal of contingencies common in the older forms. The new forms all utilize “active” written removal of contingencies, such that satisfaction of the underlying condition is not enough; there must be a written removal before a contingency is, in fact, removed. If a party does not remove it in writing, it is incumbent on the other to serve a Notice to Perform. Until all contingencies are removed in writing, Sellers always have a right to cancel. Other than the risk of cancellation, there is no penalty to the holder of the contingency if the underlying event occurs but the contingency is not removed in writing. The older C.A.R. Purchase and Sale form copyrighted 1983-1985, is different.  In

In  In

In  The out of pocket rule satisfies the goal of tort claims, which is to restore the plaintiff to the financial position he was in before the fraudulent transaction, and thus awards the difference in actual value between what the plaintiff gave and what he received.

The out of pocket rule satisfies the goal of tort claims, which is to restore the plaintiff to the financial position he was in before the fraudulent transaction, and thus awards the difference in actual value between what the plaintiff gave and what he received. In Corvello v. Wells Fargo Bank, the court framed the issue: whether the bank was contractually required to offer the plaintiff a permanent loan modification after they complied with the requirements of a trial period plan (“TPP”). The answer was yes. The court first reviewed the federal programs resulting from TARP to assist homeowners. It noted that Wells Fargo, and others, signed “Servicer Participation Agreements” with the U.S. Treasury. It entitled the lenders to incentive payments for loan modifications, and requires them to follow Treasury guidelines.

In Corvello v. Wells Fargo Bank, the court framed the issue: whether the bank was contractually required to offer the plaintiff a permanent loan modification after they complied with the requirements of a trial period plan (“TPP”). The answer was yes. The court first reviewed the federal programs resulting from TARP to assist homeowners. It noted that Wells Fargo, and others, signed “Servicer Participation Agreements” with the U.S. Treasury. It entitled the lenders to incentive payments for loan modifications, and requires them to follow Treasury guidelines. In

In