“Equitable subordination” is used to correct equitable wrongs in the priority of liens on real property. If fairness requires, a first lien or deed of trust can be subordinated, or reduced in priority below, a second lien, swapping their positions. (Civ. Code, §§ 2876, 2903, 2904. A lengthy description by the Supreme Court is copied below). When, through fraud or mistake, a party finds that his lien does not have the priority he bargained for, they should consult with a Sacramento real estate attorney to discuss equitable subordination. Such a lawsuit may result in the judge reclassifying the respective liens to make them fair. In a recent decision the court granted equitable subordination on behalf of two deeds of trust where there was both broker fraud (in forging signatures) and escrow negligence in failing to carry out instructions and reconvey a deed of trust.

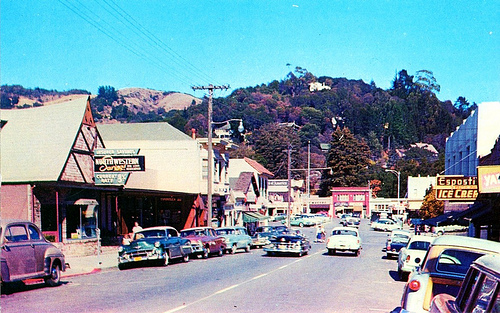

In Elbert Branscomb v. JPMorgan Chase Bank N.A., Navjot owned property on Canal Street in San Rafael. He had three loans; 1st, from Washington Mutual Bank; 2nd with MMB; and 3rd, a $500,000 loan from plaintiff Branscomb. All were secured by deeds of trust. However, Banscomb’s 3rd DOT only indicated that I the loan was for $100,000, due to the broker’s negligence. Navjot refinanced with WaMu, and Modified the MMU loan. Conditions of both were that the lenders were to keep their respective first & second positions. When the escrow officer asked Branscomb’s broker for a payoff of the third, he replied that it was zero, and signed a request for reconveyance. (Yikes, it was $500,000! This broker was bad news. He was also found to have forged his client’s signature on a number of documents. He had done this before, but Branscomb continued to work with him. They deserved each other.) Compounding the broker’s error, the escrow officer was negligent in not reconveying the Third deed of trust. When the first & second refinances recorded, Branscomb moved to 1st, and the other two dropped to 2nd & 3rd. This lawsuit for equitable subordination resulted.

In Elbert Branscomb v. JPMorgan Chase Bank N.A., Navjot owned property on Canal Street in San Rafael. He had three loans; 1st, from Washington Mutual Bank; 2nd with MMB; and 3rd, a $500,000 loan from plaintiff Branscomb. All were secured by deeds of trust. However, Banscomb’s 3rd DOT only indicated that I the loan was for $100,000, due to the broker’s negligence. Navjot refinanced with WaMu, and Modified the MMU loan. Conditions of both were that the lenders were to keep their respective first & second positions. When the escrow officer asked Branscomb’s broker for a payoff of the third, he replied that it was zero, and signed a request for reconveyance. (Yikes, it was $500,000! This broker was bad news. He was also found to have forged his client’s signature on a number of documents. He had done this before, but Branscomb continued to work with him. They deserved each other.) Compounding the broker’s error, the escrow officer was negligent in not reconveying the Third deed of trust. When the first & second refinances recorded, Branscomb moved to 1st, and the other two dropped to 2nd & 3rd. This lawsuit for equitable subordination resulted.

Knowledge of the Plaintiff’s Lien Did Not Prevent Subordination

In a recent decision the court enforced a general reference provision that did not include an explicit waiver of a jury trial. In

In a recent decision the court enforced a general reference provision that did not include an explicit waiver of a jury trial. In In

In  A dilemma arises when the property owner pays off the loan, but has not yet completed full performance of other obligations secured by the deed of trust. Usually, on paying off the loan, the borrower wants the lender to record a reconveyance of the deed of trust, effectively removing the ‘lien’ from the record. However, courts have found that reconveyance was not required. Such was the case in

A dilemma arises when the property owner pays off the loan, but has not yet completed full performance of other obligations secured by the deed of trust. Usually, on paying off the loan, the borrower wants the lender to record a reconveyance of the deed of trust, effectively removing the ‘lien’ from the record. However, courts have found that reconveyance was not required. Such was the case in

Under Proposition 13 real property tax is based on “full cash value,” meaning “the appraised value of real property when purchased, newly constructed, or

Under Proposition 13 real property tax is based on “full cash value,” meaning “the appraised value of real property when purchased, newly constructed, or  This was the problem presented in a recent decision, where the court found that numerous lease terms ended of the course of the prescriptive period; in one instance the property did not have a tenant for over a year. If the owner never had a possessory right during the prescription period, he had a defense to the prescriptive easement claim. However, in this case, the lessor / owner did not have a tenant the entire period, so the court concluded it should have taken action to prevent the trespassing use. Parties in such situtations may want to consult an experienced

This was the problem presented in a recent decision, where the court found that numerous lease terms ended of the course of the prescriptive period; in one instance the property did not have a tenant for over a year. If the owner never had a possessory right during the prescription period, he had a defense to the prescriptive easement claim. However, in this case, the lessor / owner did not have a tenant the entire period, so the court concluded it should have taken action to prevent the trespassing use. Parties in such situtations may want to consult an experienced  The beneficiary can extend the time by recording a “notice of intent to preserve interests” prior to the expiration of the prescribed time period. If this notice is timely recorded, the period is extended until 10 years after the notice is recorded. Civil Code section 880.310(a), 880.020(a)(3). If one has a concern about the limitations of their deed of trust, they should consult a

The beneficiary can extend the time by recording a “notice of intent to preserve interests” prior to the expiration of the prescribed time period. If this notice is timely recorded, the period is extended until 10 years after the notice is recorded. Civil Code section 880.310(a), 880.020(a)(3). If one has a concern about the limitations of their deed of trust, they should consult a  The Civil Code

The Civil Code

In

In