Generally with California commercial properties, when a tenant defaults there is an unlawful detainer, and the landlord is awarded as damages the rent due until the judgment. If the lease contract would have gone for a longer term, the landlord may later sue for the balance of the rent due for the remainder of the terminated lease. In a confusing decision from Southern California, the landlord collected more from the later tenants than the evicted tenant could ever owe.

Kumar v Yu involved a shopping center lease that was not to end until July 2006. In November 2003 the first tenant was evicted, and the landlord got a default judgment for rent then due. (This default was set aside, but there is not further explanation in the decision). The landlord rented to a second tenant, who was evicted. The unlawful detailed included a judgment for over $21,000, which was paid. The landlord rented to a third tenant, who agreed to a much higher monthly rent. In 2007 the landlord sued the first tenant for the balance of the rent due under the original lease.

Kumar v Yu involved a shopping center lease that was not to end until July 2006. In November 2003 the first tenant was evicted, and the landlord got a default judgment for rent then due. (This default was set aside, but there is not further explanation in the decision). The landlord rented to a second tenant, who was evicted. The unlawful detailed included a judgment for over $21,000, which was paid. The landlord rented to a third tenant, who agreed to a much higher monthly rent. In 2007 the landlord sued the first tenant for the balance of the rent due under the original lease.

Generally, to recover damages from a tenant for the remainder of the term after a commercial lease has been terminated, the lease must provide that the…

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

In

In  Two pedestrians were stuck by a car while crossing the street in Los Altos. They suffered serious injuries, and in a lawsuit named the city claiming this was a dangerous intersection. The city cross-sued the homeowner, charging that a large tree was a hazard and blocked visibility. The tree was not on the homeowner’s property, but adjacent to it. The owner never trimmed the trees, but PG&E did because there were power lines running through it- PG&E told the owner not to touch it. Now the owner needs to be worried about

Two pedestrians were stuck by a car while crossing the street in Los Altos. They suffered serious injuries, and in a lawsuit named the city claiming this was a dangerous intersection. The city cross-sued the homeowner, charging that a large tree was a hazard and blocked visibility. The tree was not on the homeowner’s property, but adjacent to it. The owner never trimmed the trees, but PG&E did because there were power lines running through it- PG&E told the owner not to touch it. Now the owner needs to be worried about  In

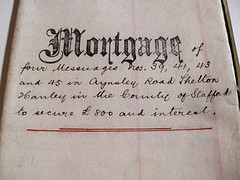

In  In historical terms, the California deed of trust is a recent development. Originally parties used a “mortgage” in which the property was conveyed by the buyer to the lender, subject to payment of the debt. Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit. The property was conveyed to the buyer, who kept the right to possession, but he then conveys “nominal title” to the trustee, who, on instruction from the lender, could hold a foreclosure (by trustee’s sale) without court involvement. Borrowers and lenders concerned with the difference should contact an

In historical terms, the California deed of trust is a recent development. Originally parties used a “mortgage” in which the property was conveyed by the buyer to the lender, subject to payment of the debt. Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit. The property was conveyed to the buyer, who kept the right to possession, but he then conveys “nominal title” to the trustee, who, on instruction from the lender, could hold a foreclosure (by trustee’s sale) without court involvement. Borrowers and lenders concerned with the difference should contact an  2923.5

2923.5 To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be

To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be  In seeking the injunction, the borrowers swore in declarations that at no time prior to the notice of default did the lender contact the borrower to explore options as required by

In seeking the injunction, the borrowers swore in declarations that at no time prior to the notice of default did the lender contact the borrower to explore options as required by  Connolly bought three adjacent lots in Garberville. On the northern boundary of Lot 17 they fenced off a portion so that it was part of their adjacent lot to the North. In other words, they were using a portion of the Northen end of Lot 17. They made a deal with Dobbs to sell him lot 17, with the oral agreement that Connally would keep title to the fenced off portion of 17, and there would be a “lot line adjustment” to accomplish that.

Connolly bought three adjacent lots in Garberville. On the northern boundary of Lot 17 they fenced off a portion so that it was part of their adjacent lot to the North. In other words, they were using a portion of the Northen end of Lot 17. They made a deal with Dobbs to sell him lot 17, with the oral agreement that Connally would keep title to the fenced off portion of 17, and there would be a “lot line adjustment” to accomplish that. In a recent case the lender tried to claim that, because a tenant abandoned the premises, the bad boy was triggered and the guarantor was liable.

In a recent case the lender tried to claim that, because a tenant abandoned the premises, the bad boy was triggered and the guarantor was liable.