California real estate law, and often commercial rental agreements, provide the tenant with a right of quiet enjoyment. This means that the landlord promises that during the term of the tenancy no one will disturb the tenant in the tenant’s use and enjoyment of the premises.

If the covenant of quiet enjoyment is breached, the tenant has a choice- he can stand on his lease and sue for damages, or vacate the premises and claim constructive eviction. A 1994 Third District decision found that the a Lease provision prohibited the lessee’s claim for constructive eviction, restricting his rights to a claim for damages or injunctive relief. While this is bad for tenants, the law is clear, and Commercial landlords and tenants entering leases should consult with an experienced Sacramento real estate and leasing attorney to be fully advised as to the terms of their contracts.

In Lee v. Placer Title Company Placer was the tenant in a shopping center. Their premises were next door to a dry cleaners. Placer claimed that cleaning fumes made the office unusable, stopped paying rent, and vacated the premises. Lee sued for the balance of the rent owed on the lease as damages. Placer raised, as a defense, constructive eviction.

In Lee v. Placer Title Company Placer was the tenant in a shopping center. Their premises were next door to a dry cleaners. Placer claimed that cleaning fumes made the office unusable, stopped paying rent, and vacated the premises. Lee sued for the balance of the rent owed on the lease as damages. Placer raised, as a defense, constructive eviction.

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

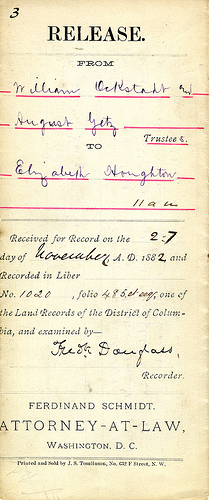

While the principals were overseas, Chang, the lender, successfully foreclosed the deed of trust and became owner of the 25% interest in the property. To further collect on the balance of the money owed by Mali, the Lender sued her. Mali had CFI assign to her “all of its right, title, interest, and standing to bring suit, to, in, and on, any and all claims and causes of action which it has against Chen…” Mali then filed a cross-complaint against the Lender for wrongful foreclosure & slander of title. However, Mali had to dismiss her claims just before trial, because CFI’s corporate status had been suspended, and thus had no power to pursue legal actions- as a result, the assignment of claims to Mali was void. Mali assigned the claims back to CFI.

While the principals were overseas, Chang, the lender, successfully foreclosed the deed of trust and became owner of the 25% interest in the property. To further collect on the balance of the money owed by Mali, the Lender sued her. Mali had CFI assign to her “all of its right, title, interest, and standing to bring suit, to, in, and on, any and all claims and causes of action which it has against Chen…” Mali then filed a cross-complaint against the Lender for wrongful foreclosure & slander of title. However, Mali had to dismiss her claims just before trial, because CFI’s corporate status had been suspended, and thus had no power to pursue legal actions- as a result, the assignment of claims to Mali was void. Mali assigned the claims back to CFI. In

In  In

In  In

In  n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

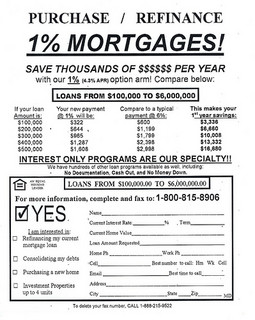

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to  The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale.

The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale.