A deed of trust represents security for the loan. It has several parties- a) the trustor, who is the borrower and owner of record for the real property that is security for the loan; b) the beneficiary, who is the lender whose debt is secured by the deed of trust; and c) the trustee, who holds bare legal title only for the purpose of conveying it in the event of a foreclosure. The deed of trust contains a “power of sale,” giving the trustee the ability to foreclose. Once the deed of trust is created and recorded, if there is a default, the beneficiary routinely changes who the trustee is by recording a “substitution of trustee,” putting a new trustee in the job. Homeowners in this situation should consult with a Sacramento and Yolo real estate attorney to determine their rights. In a recent case, the borrower- homeowner who lost their property to foreclosure realized that the original deed of trust did not name a trustee, and sued to set aside the foreclosure sale. The court said no.

In Shuster vs. BAC Home Loans Servicing LP (formerly known as Countrywide Loan Servicing) Shuster borrowed $670,000 to buy a house in Simi Valley. Mortgage Electronic Registration Systems, Inc. (MERS) was named beneficiary; but there was no trustee named in the document. Shuster ended up in default, MERS recorded a Substitution of Trustee, and the new trustee foreclosed. Shuster brought this action.

In Shuster vs. BAC Home Loans Servicing LP (formerly known as Countrywide Loan Servicing) Shuster borrowed $670,000 to buy a house in Simi Valley. Mortgage Electronic Registration Systems, Inc. (MERS) was named beneficiary; but there was no trustee named in the document. Shuster ended up in default, MERS recorded a Substitution of Trustee, and the new trustee foreclosed. Shuster brought this action.

Shuster argued that, with no trustee, there was no one to receive the conveyance of bare legal title. This transforms the deed of trust into a standard mortgage. Under California law, a mortgage that is not standard deed of trust (with a power of sale) may only be foreclosed by judicial foreclosure – filing a lawsuit for foreclosure and obtaining a court order.

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

In

In  The problem arose when Chase asked the bank to take “

The problem arose when Chase asked the bank to take “ In

In  In

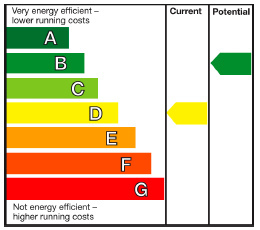

In  ENERGY USE REPORTING

ENERGY USE REPORTING In

In  In

In  In

In  1. Original lender holds both first & second, forecloses on first.

1. Original lender holds both first & second, forecloses on first.