California deeds of trust, which secure debt on real property, involves three parties. First, is the Trustor, who borrowed the money. Second is the Beneficiary, who lent the money. Third is the Trustee, whom sort of holds title to the property for the benefit of the beneficiary, and has the power of sale. If the debtor fails to pay the loan, the beneficiary/lender may instruct the trustee to begin the foreclosure process, resulting in a trustee’s sale, at which the lender may make a credit bid. The purpose of this arrangement is to give the lender a quick and easy way to deal with a defaulting borrower. Sometimes there are errors in the process, major and minor, and parties involved may want to consult a Sacramento real estate and foreclosure attorney to clarify their rights. As a disappointed buyer at a trustee sale learned recently, courts distinguish between the type and timing of errors made by the parties, in occasionally allowing the trustee to set aside a sale they made, and allow them to start over.

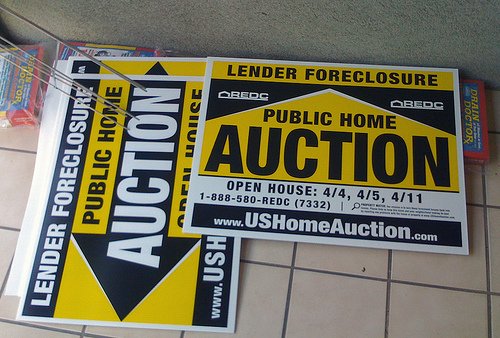

In David Biancalana v. T.D. Service Company, Biancalana was the successful buyer at a trustee sale for a property in Watsonville. The problem arose because the trustee made a mistake on the credit bid. Civil Code section 2924h requires that bidders at a trustee sale must bring cash, but that the beneficiary (lender) can make a “credit bid’; they can make a bid up to the total amount due, including the trustee’s fees and expenses, without bring any cash to the sale. Here, the beneficiary told the trustee that the total debt, or its credit bid, was $$219,105. However, T.D., the trustee, told its auctioneer that the total debt was only $21,894.17. The day before the sale Biancalana contacted the trustee and confirmed that the debt was only $21,894; at the sale, the auctioneer verified that this was the opening bid, so Biancalana won the auction with a bid of only $22,000- jackpot!

In David Biancalana v. T.D. Service Company, Biancalana was the successful buyer at a trustee sale for a property in Watsonville. The problem arose because the trustee made a mistake on the credit bid. Civil Code section 2924h requires that bidders at a trustee sale must bring cash, but that the beneficiary (lender) can make a “credit bid’; they can make a bid up to the total amount due, including the trustee’s fees and expenses, without bring any cash to the sale. Here, the beneficiary told the trustee that the total debt, or its credit bid, was $$219,105. However, T.D., the trustee, told its auctioneer that the total debt was only $21,894.17. The day before the sale Biancalana contacted the trustee and confirmed that the debt was only $21,894; at the sale, the auctioneer verified that this was the opening bid, so Biancalana won the auction with a bid of only $22,000- jackpot!

However, two days later, before delivering the sale deed, the trustee contacted the buyer and said sorry, we made a mistake. The buyer sued. The court first noted that, when a trustee’s sale deed is delivered, and it has the statutory recitals, then a conclusive presumption arises that the sale is good. However, here, there was no deed. If there is a defect is the process identified before the deed, the trustee may abort the sale and start over if there is “gross inadequacy of price coupled with even slight unfairness or irregularity…” Here, there was gross inadequacy of price. The mistaken opening bid was less that 10% of the actual debt.

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

The case is

The case is  However, there is a limit to how long the court may keep jurisdiction over the parties. In

However, there is a limit to how long the court may keep jurisdiction over the parties. In  Civil Code

Civil Code  In

In  In

In  Questions of conflicting rulings are occasionally seen by

Questions of conflicting rulings are occasionally seen by  In

In  “Judicial notice” is the court’s recognition of the existence of a matter of law or fact without the necessity of formal proof. It can be described as a substitute for (formal) proof, a judicial shortcut, doing away with the formal necessity for evidence. Judicial notice is limited to matters which are indisputably true. A request for judicial notice can be defeated by showing the matter is reasonably subject to dispute. In California state court, Judicial Notice is limited by the

“Judicial notice” is the court’s recognition of the existence of a matter of law or fact without the necessity of formal proof. It can be described as a substitute for (formal) proof, a judicial shortcut, doing away with the formal necessity for evidence. Judicial notice is limited to matters which are indisputably true. A request for judicial notice can be defeated by showing the matter is reasonably subject to dispute. In California state court, Judicial Notice is limited by the